- About Us

- OUR OFFERINGS

- CALCULATORS

- RESOURCE CENTRE

-

Quick Links

- Existing Customers Benefits

- Become a Partner

- Pre-Approved Projects

- Home Loan App

- Blog

- CSR

- Locations

- Roi Switch Policy

- Co-Lending Policy

- Co-Lending Partnerships

- Customer Sensitization Program

- ROI Range

- Borrower Education - SMA/ NPA classification

- Borrower Awareness - RBI Ombudsman Scheme

- Borrower Awareness - procedure for handover of property documents

- NEWS CORNER

-

INVESTOR RELATIONS

- Financial Reports

- Investor Presentations

- Annual Reports

- Notices

- ESG Profile

- IEPF

- Investor Call Transcript

- Corporate Announcement

- Public Issue of NCD'S

- Qualified Institutional Placement

- Investor Relations Contact

- Familiarisation Programmes

- ISO CERTIFICATIONS

- Forms for Shareholder KYC-PAN-Nomination update

- Credit Ratings

- Statutory Advertisements

- ODR Portal

- Rights Issue

- Sustainable Financing Framework

- CONTACT US

- Login

Apply

ApplyOnline

India's 1st Completely Online Home Loan!

-

e-APPLY

-

e-SANCTION

-

e-DISBURSE

Start your eHome Loans Process Now!

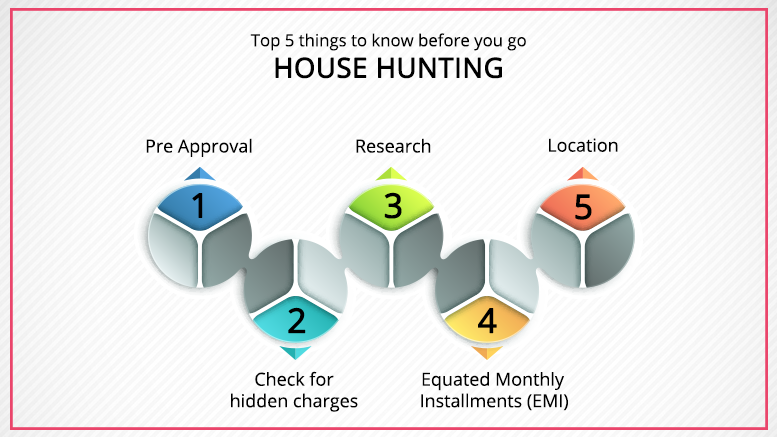

Apply OnlineTop 5 things to know before you go house hunting

- Home Loans Guide

- Jul 02, 2015

- VIEWS: 2851

Who doesn’t want a place they can call home? Home is where the heart is, isn’t it? Well here are a few essentials you should keep in mind before you buy your safe haven. 1). Pre Approval: The first and most essential element you must keep in mind before you finalize on a flat, is to know whether you are eligible for a loan and the amount of loan you are eligible for. This amount is usually 60 times your monthly net income. For example if you’re monthly net income is Rs. 40,000/-, you will be eligible for a loan amount of Rs. 24,000,00/-. Therefore try looking for a house around this figure. However if you’re married you could take a joint loan, which will be higher because the net monthly income of you and your spouse will be merged and taken as one. Make sure you get a pre approval from the bank before looking for a house. 2). Check for hidden charges: The cheapest is not always the best. Many a times banks reduce the rate of interest on loans to make it look more attractive. Look for hidden charges that banks won’t disclose at the outset such as the processing fees, legal fees, administrative fees etc. We have spoken about these hidden costs in detail in another blog you must definitely give a read to. Speak to the banks you have shortlisted and find out all the costs before hand and add it up. Then go about selecting the best bank. 3). Research: Today there are several online portals to assist you in finding your dream home. Type in your budget (in accordance with the loan amount you are entitled to), location preference and housing type and you will be presented with several houses that suit your requirement. Make sure you do a background check on the builder before you make your selection. Spend some quality time on research. It will surely be worth the effort. 4). Location: Before you buy your dream flat, be sure to check the accessibility of the area you’ve chosen. You rather pay a little more and buy a flat, which is accessible, than spend more on transportation staying away from important landmarks. Also make sure you don’t finalize on a flat in a low-lying area. It would get easily flooded during the monsoons. Factor in the location of the house before you select your dream home. 5). Equated Monthly Instalments (EMI): It is the amount payable by the borrower to the lender on a specific date every month. Your EMI will depend upon the duration of the loan. Ask your bank for your EMI on the home loan. Now check whether you will be able to manage that payment every month. However if the EMI is eating a huge sum of your monthly income, ask the bank to increase the duration of the loan and reduce your EMI. This will help you make the payments in future without any worry. If your EMI’s are still looking too high, you can decide to wait a while or look for other affordable options available. Once you have done the above successfully you are all set to take the big step. Just remember one thing. Don’t hurry. This is a long term investment, so take your time and invest smartly. Related Articles:

- 10 Tips For A Best Home Loan Experience

- 10 Factors You Need To Consider While Taking A Home Loan

- Home Loans, Things To Keep In Mind

The post Top 5 things to know before you go house hunting appeared first on Indiabulls home loans.

Top up home loan vs personal loan a comparison to determine the better choice for loans

Taking on a loan of any kind is a financial responsibility. It is a debt that needs to be repaid, in full, based on the tenure chosen by the borrower. Most banks, housing finance companies and non-banking finance companies offer a myriad of loans to finance the different needs of customers.

- Home Loans Guide

- Jul 23, 2019

- VIEWS: 8934

MCLR in Home Loan

The interest rate is one of the most important components of a loan, especially in the case of a high-value loan that lasts for 2 decades or more; the home loan.

- Home Loans Guide

- May 24, 2019

- VIEWS: 6690

Types of Home Loan Charges

Most people fulfil their wish of becoming homeowners by taking out a home loan. It is the easiest way to afford a property as one can pay for the house in monthly instalments.

- Home Loans Guide

- May 24, 2019

- VIEWS: 7998

No Comments

Subscribe

Most Viewed Blogs

Categories

- Home Loans Guide 125

- Home Renovation Loan Guide 3

- Home Loan Transfer Guide 14

- Home Extension Loans Guide 1

- Loan Against Property Guide 28

- Home Loan Interest Rates Guide 2

- Others Guide 8

- Home Decor & Lifestyle Guide 5

- Plot Loan Guide 3

- PMAY Guide 5

- Uncategorized Guide 1

- NRI Home Loans Guide 5

- Financial Resolutions Guide 1

- New Year Resolutions Guide 1

Archives

- Mar 2020

- Jan 2020

- Nov 2019

- Jul 2019

- Jun 2019

- May 2019

- Apr 2019

- Mar 2019

- Feb 2019

- Jan 2019

- Dec 2018

- Nov 2018

- Jul 2018

- Jun 2018

- May 2018

- Apr 2018

- Mar 2018

- Feb 2018

- Jan 2018

- Dec 2017

- Nov 2017

- Oct 2017

- Sep 2017

- Aug 2017

- Jul 2017

- Jun 2017

- May 2017

- Apr 2017

- Mar 2017

- Feb 2017

- Jan 2017

- Dec 2016

- Nov 2016

- Oct 2016

- Jun 2016

- Apr 2016

- Mar 2016

- Feb 2016

- Jan 2016

- Dec 2015

- Nov 2015

- Oct 2015

- Sep 2015

- Aug 2015

- Jul 2015

- Jun 2015