- About Us

- OUR OFFERINGS

- CALCULATORS

- RESOURCE CENTRE

-

Quick Links

- Existing Customers Benefits

- Become a Partner

- Pre-Approved Projects

- Home Loan App

- Blog

- CSR

- Locations

- Roi Switch Policy

- Co-Lending Policy

- Co-Lending Partnerships

- Customer Sensitization Program

- ROI Range

- Borrower Education - SMA/ NPA classification

- Borrower Awareness - RBI Ombudsman Scheme

- Borrower Awareness - procedure for handover of property documents

- NEWS CORNER

-

INVESTOR RELATIONS

- Financial Reports

- Investor Presentations

- Annual Reports

- Notices

- ESG Profile

- IEPF

- Investor Call Transcript

- Corporate Announcement

- Public Issue of NCD'S

- Qualified Institutional Placement

- Investor Relations Contact

- ISO CERTIFICATIONS

- Forms for Shareholder KYC-PAN-Nomination update

- Credit Ratings

- Statutory Advertisements

- ODR Portal

- Rights Issue

- Sustainable Financing Framework

- Disclosures under Regulation 46 of SEBI LODR

- CONTACT US

- Login

Apply

ApplyOnline

India's 1st Completely Online Home Loan!

-

e-APPLY

-

e-SANCTION

-

e-DISBURSE

Start your eHome Loans Process Now!

Apply OnlineImportance of a good credit score for a home loan

- Home Loans Guide

- Jun 26, 2015

- VIEWS: 5202

Why credit score is important for home loans and how to improve it

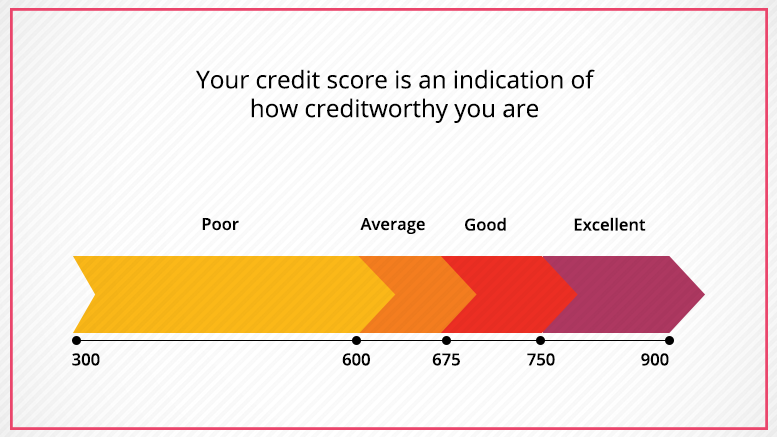

No matter what kind of loan you apply for, lenders need to ensure that you have the capacity to repay it. To confirm your repayment capacity, they ask you to submit a lot of documents – from your salary slips and bank statements to your income tax returns -- and also consider your credit score. A credit score is a three-figure number that helps lenders understand how often you borrow sums on credit and whether or not you are repaying the loans regularly. Credit scores are especially important when you apply for a home loan. Here’s why lenders ask to see your credit score to buy a house and why it is important.

Importance of credit score to get a home loan approved

The following are the main reasons why banks consider your credit scores

-

It helps the lender understand your credit behaviour

From the different types of loans you have taken in the past to the ones you are repaying currently (while applying for the loan), lenders can see how you handle credit. Credit scores are calculated not just from the loans you have taken, but from how you have used your credit cards. Lenders can get an insight into how much you use your credit card, your credit utilisation ratio and whether you have repaid both your credit card bills and previous and current loans on time, without defaulting. As such, the credit score gives your lender a detailed look into how you manage all kinds of credit. -

It helps the lender see if you have the capacity to repay the loan

When you apply for a home loan, you need to prove your eligibility. One of the best ways to check if you are eligible is through your income sources. Lenders require you to comply with the minimum income requirement. If you are not drawing a certain monthly income, you may not be eligible for the loan. Your income and credit scores help lenders decide if you can indeed repay the loan on time, which is why lenders consider your credit score for house loan. -

It helps lenders see if you have any other ongoing loans

Borrowers who have ongoing loans while they apply for another loan are considered rather risky by lenders. A new loan means an added financial responsibility while your income remains the same. Through your credit score, the lender calculates if you can repay a high-value home loan. They check your loan to value ratio -- i.e. the monthly income drawn and the amount of money spent in repaying your credit card bills and your other loan EMIs. If the loan to value ratio exceeds 60%, lenders can consider you ineligible for the loan.

How to improve credit scores

The credit score needed for home loan is a minimum of 750 points out of a possible 900. Here’s how you can improve the score

-

Ensure you don’t have any outstanding debts

Whether it’s any other loan or your latest credit card bill, ensure you have paid them all off before you apply for the home loan. Not having any outstanding debt – just the regular credit card cycle (which shows that you are taking those mini loans but also repaying them month after month) -- can help you get your home loan passed. -

Don’t utilise your entire credit limit

Another way to improve your credit score for home loan is to ensure you never use up your entire credit limit. Lenders prefer to sanction loans of borrowers who never utilise more than 30% of their credit limit. As such, you must limit your credit utilisation ratio to this 30%. This simply means that if your credit limit is Rs.100,000, you should only spend Rs.30,000 on your credit card each month. -

Repay your debts without defaulting

A sure-shot way to improve your credit score is to repay your debts without ever defaulting. Ensure you never miss your EMI payments and avoid paying them late. Also, try not to just pay the minimum amount necessary for your credit card debts and pay off the entire amount before the new credit cycle begins. If the lender sees you defaulting on any debt, your loan could be rejected.

Final Word: The credit score required for home loan is 750 and above. Most lenders, especially banks, are quite rigid and only sanction loans to borrowers who can achieve this minimum score. Housing finance companies, on the other hand, are more lenient with regard to credit scores and may sanction loans to borrowers with credit score ranging between 600 and 750. But while you can get the loan, the interest rate levied on it is generally high.

Related Articles:

- How to Improve Your Credit Score Before Applying for A Home Loan

- 5 Steps Guide To Ease The Home Loan Process

- 10 Secrets To Get A Perfect Home Loan

The post Importance of a good credit score for a home loan appeared first on Indiabulls home loans.

Top up home loan vs personal loan a comparison to determine the better choice for loans

Taking on a loan of any kind is a financial responsibility. It is a debt that needs to be repaid, in full, based on the tenure chosen by the borrower. Most banks, housing finance companies and non-banking finance companies offer a myriad of loans to finance the different needs of customers.

- Home Loans Guide

- Jul 23, 2019

- VIEWS: 8940

MCLR in Home Loan

The interest rate is one of the most important components of a loan, especially in the case of a high-value loan that lasts for 2 decades or more; the home loan.

- Home Loans Guide

- May 24, 2019

- VIEWS: 6695

Types of Home Loan Charges

Most people fulfil their wish of becoming homeowners by taking out a home loan. It is the easiest way to afford a property as one can pay for the house in monthly instalments.

- Home Loans Guide

- May 24, 2019

- VIEWS: 8006

No Comments

Subscribe

Most Viewed Blogs

Categories

- Home Loans Guide 125

- Home Renovation Loan Guide 3

- Home Loan Transfer Guide 14

- Home Extension Loans Guide 1

- Loan Against Property Guide 28

- Home Loan Interest Rates Guide 2

- Others Guide 8

- Home Decor & Lifestyle Guide 5

- Plot Loan Guide 3

- PMAY Guide 5

- Uncategorized Guide 1

- NRI Home Loans Guide 5

- Financial Resolutions Guide 1

- New Year Resolutions Guide 1

Archives

- Mar 2020

- Jan 2020

- Nov 2019

- Jul 2019

- Jun 2019

- May 2019

- Apr 2019

- Mar 2019

- Feb 2019

- Jan 2019

- Dec 2018

- Nov 2018

- Jul 2018

- Jun 2018

- May 2018

- Apr 2018

- Mar 2018

- Feb 2018

- Jan 2018

- Dec 2017

- Nov 2017

- Oct 2017

- Sep 2017

- Aug 2017

- Jul 2017

- Jun 2017

- May 2017

- Apr 2017

- Mar 2017

- Feb 2017

- Jan 2017

- Dec 2016

- Nov 2016

- Oct 2016

- Jun 2016

- Apr 2016

- Mar 2016

- Feb 2016

- Jan 2016

- Dec 2015

- Nov 2015

- Oct 2015

- Sep 2015

- Aug 2015

- Jul 2015

- Jun 2015